MP Materials’ Ascent is capturing investor attention as the rare-earth miner and refiner demonstrates significant potential. The company’s stock experienced a surge following the release of its second-quarter earnings, which surpassed expectations. While current financial metrics, such as a reported negative EBITDA of $12.5 million from sales of $57.4 million, are noteworthy, the long-term prospects, particularly following a substantial deal with the Department of Defense, are driving much of the excitement. This article delves into the details of MP Materials’ recent performance, the strategic importance of its partnerships, and the factors contributing to its optimistic future.

Table of Contents

Second-Quarter Earnings: A Closer Look

MP Materials’ second-quarter earnings revealed a complex financial picture. Although the company posted a negative EBITDA of $12.5 million, this figure exceeded Wall Street’s anticipation of a $20 million loss. Sales reached $57.4 million, also surpassing the expected $46 million. These numbers, while indicative of current performance, are viewed by investors as less critical than the company’s anticipated future growth trajectory. The focus is now shifting towards how strategic investments and partnerships will translate into substantial revenue and profitability in the coming years. According to the Moomoo news article, these results fueled investor optimism and a subsequent stock surge.

The Department of Defense “Transformation Deal”

A pivotal development for MP Materials is the “transformation deal” secured with the Department of Defense (DoD) in July. This agreement involves a $400 million equity investment, a commitment of up to $350 million in additional funding, and a $150 million loan. The primary objective of this financial infusion is to establish a new domestic rare-earth magnet-manufacturing facility and to expand existing mining and processing capabilities. This initiative is strategically aligned with the U.S. government’s broader objective of reducing reliance on foreign sources, particularly China, for critical rare-earth materials.

Strategic Significance of the DoD Partnership

The DoD’s investment in MP Materials underscores the strategic importance of securing a domestic supply chain for rare-earth elements. These materials are essential components in various defense technologies, including missile guidance systems, communication devices, and electronic warfare systems. By supporting MP Materials, the DoD aims to mitigate the risks associated with relying on foreign suppliers for these critical resources. The Moomoo article highlights this deal as a game-changer for MP Materials, providing a clear pathway to significant annual EBITDA by the end of the decade.

Commercial Agreements: Apple and General Motors

In addition to government support, MP Materials has forged significant commercial agreements with major corporations. The company has established partnerships with Apple and General Motors (GM) for the supply of rare-earth materials. These agreements not only diversify MP Materials’ revenue streams but also validate the quality and reliability of its products. The demand from such high-profile customers reinforces the company’s position as a key player in the rare-earth industry.

Impact of Supply Agreements

The supply agreements with Apple and General Motors provide MP Materials with a stable and predictable demand for its rare-earth products. These partnerships are crucial for securing long-term revenue and profitability. Furthermore, they enhance the company’s reputation and attract further investment. The commitment from these industry giants signals confidence in MP Materials’ ability to meet stringent quality standards and deliver materials consistently.

Stock Performance and Investor Confidence

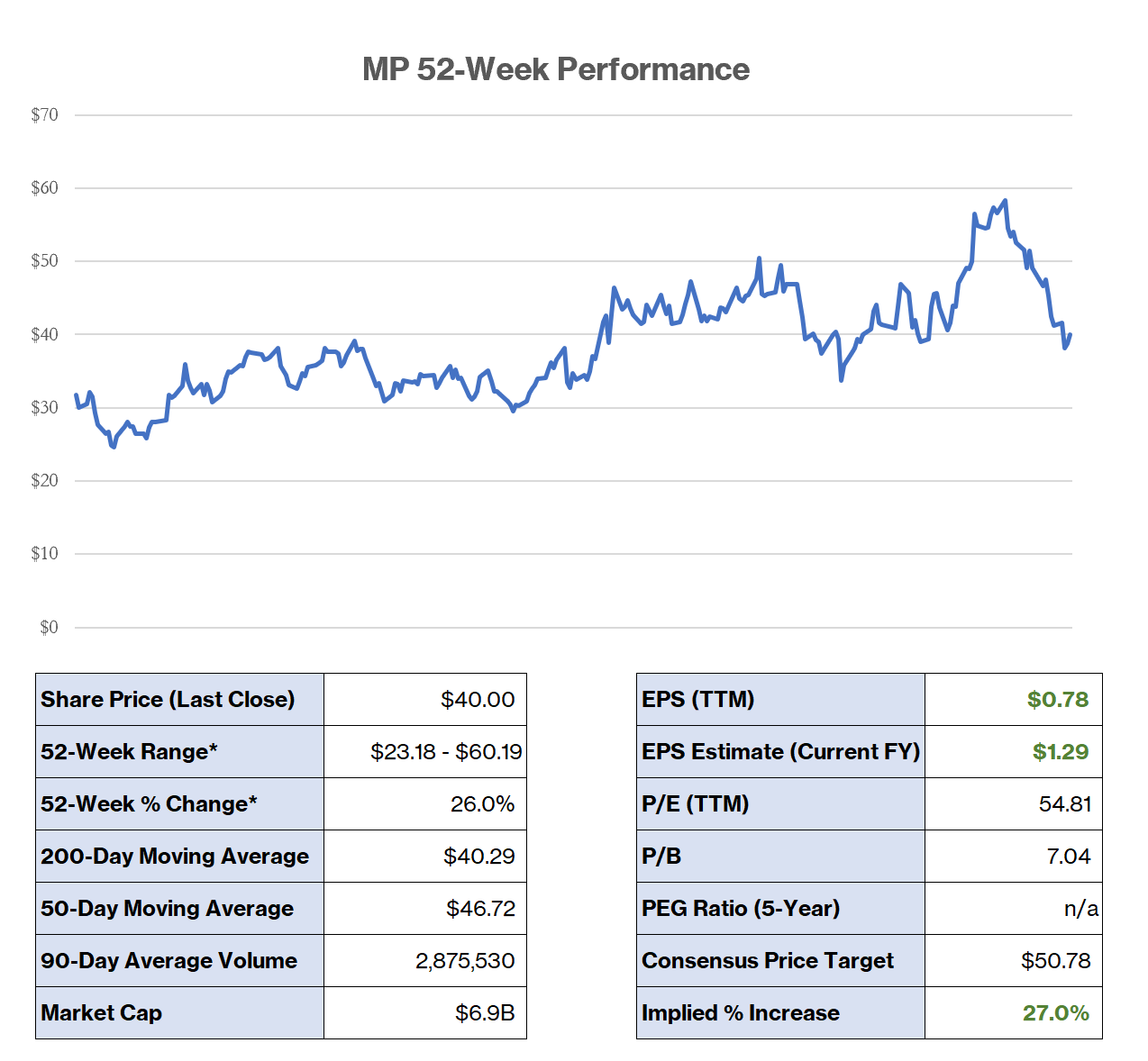

The positive news surrounding MP Materials’ earnings and strategic partnerships has significantly impacted its stock performance. The stock has experienced substantial gains, increasing by approximately 200% over the past three months. This surge reflects growing investor confidence in the company’s future prospects. The stock has also reached a new 52-week and all-time high, indicating strong market sentiment and a positive outlook for continued growth. The Moomoo article attributes this surge directly to the better-than-expected earnings and the transformative DoD deal.

Analyzing the Stock Surge

The substantial increase in MP Materials’ stock price is a clear indicator of investor enthusiasm. Several factors contribute to this positive trend, including the company’s ability to exceed earnings expectations, the strategic importance of its DoD partnership, and the establishment of commercial agreements with Apple and General Motors. These developments collectively paint a picture of a company poised for significant growth and long-term success. The market’s response reflects a belief in MP Materials’ ability to capitalize on the increasing demand for rare-earth materials and its strategic position in the industry.

The Future of Rare-Earth Magnet Manufacturing

The establishment of a new domestic rare-earth magnet-manufacturing facility, supported by the DoD’s investment, is a critical step towards securing a reliable supply chain for these essential components. Rare-earth magnets are used in a wide range of applications, including electric vehicles, wind turbines, and medical devices. By increasing domestic production capacity, MP Materials is contributing to the growth of these industries and reducing the nation’s dependence on foreign suppliers. The Moomoo article emphasizes the long-term EBITDA potential this facility unlocks.

Domestic Rare-Earth Independence

The push for domestic rare-earth independence is driven by concerns about supply chain vulnerabilities and geopolitical risks. By establishing a robust domestic industry, the U.S. can reduce its reliance on foreign sources and ensure a stable supply of these critical materials. MP Materials plays a key role in this effort, leveraging its mining and processing capabilities to meet the growing demand for rare-earth elements. The company’s strategic partnerships and government support position it as a leader in the effort to secure a domestic rare-earth supply chain.

Conclusion

MP Materials is strategically positioned for substantial growth, fueled by better-than-expected earnings, a transformative partnership with the Department of Defense, and key commercial agreements with industry leaders like Apple and General Motors. The company’s focus on expanding domestic rare-earth magnet manufacturing capabilities aligns with national security interests and reduces reliance on foreign suppliers. As investor confidence grows, MP Materials is charting a course towards a bright future, driven by increasing demand for rare-earth materials and its commitment to innovation and strategic partnerships.