Imagine a world where understanding your finances is as easy as asking a question and seeing the answer visualized before your eyes. Google AI’s advancements are making this a reality, transforming complex financial data into easily digestible charts and graphs, helping users make informed decisions with unprecedented clarity. This new approach is revolutionizing personal finance management and empowering individuals to take control of their financial futures by leveraging Google AI Visualizes Your Finance Questions! in an innovative way.

The Dawn of Visual Finance with AI

For years, financial data has been the domain of spreadsheets and complex reports, often intimidating to the average person. Google AI is changing that by providing a visual layer that simplifies understanding and encourages engagement. This shift towards visual finance democratizes access to critical financial information, enabling more people to make smarter choices about their money.

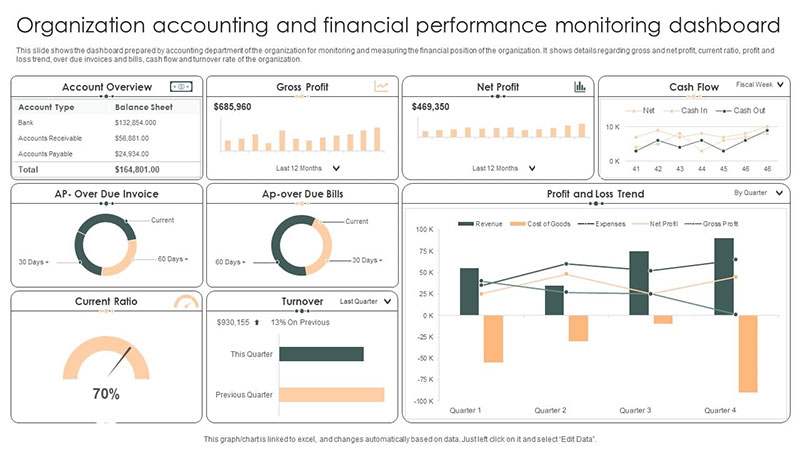

The core idea is simple: users ask questions about their finances, and Google AI generates visualizations to answer those questions. This could range from simple queries like “What were my expenses last month?” to more complex questions such as “How is my investment portfolio performing compared to the market average?” The AI then processes the data and presents it in an intuitive visual format, such as a bar chart, line graph, or pie chart.

Benefits of Visualizing Financial Data

Visualizing financial data offers several key advantages over traditional methods:

- Improved Comprehension: Visuals are processed by the brain much faster than text or numbers. This means users can quickly grasp key trends and insights without having to wade through dense reports.

- Enhanced Engagement: Visualizations are more engaging and less intimidating than spreadsheets. This encourages users to actively explore their financial data and identify areas for improvement.

- Better Decision-Making: By presenting data in a clear and concise format, visualizations empower users to make more informed decisions about their finances. They can easily see the impact of different choices and adjust their strategies accordingly.

- Early Issue Detection: Visual representations can quickly highlight anomalies or potential problems that might be missed in a traditional report.

How Google AI Visualizes Your Finance Questions!

Google AI leverages several advanced technologies to transform financial questions into insightful visualizations. These include:

- Natural Language Processing (NLP): NLP allows the AI to understand the user’s questions, even if they are phrased in different ways. The AI can identify the key concepts and entities in the question and extract the relevant data.

- Machine Learning (ML): ML algorithms are used to analyze financial data and identify patterns and trends. This allows the AI to generate visualizations that highlight the most important insights.

- Data Visualization Libraries: Google AI utilizes powerful data visualization libraries to create a wide range of charts and graphs. These libraries allow the AI to customize the visualizations to best suit the data and the user’s needs.

The process typically involves these steps:

- User Input: The user asks a question about their finances through a text or voice interface.

- NLP Processing: The AI processes the question using NLP to understand the user’s intent and extract the relevant information.

- Data Retrieval: The AI retrieves the necessary financial data from various sources, such as bank accounts, credit card statements, and investment portfolios.

- Data Analysis: The AI analyzes the data using ML algorithms to identify patterns and trends.

- Visualization Generation: The AI generates a visualization that presents the data in a clear and concise format.

- Output: The visualization is displayed to the user through a web or mobile interface.

Examples of Visualizations in Action

Let’s look at some specific examples of how Google AI can visualize financial questions:

Tracking Spending Habits

A user might ask, “Where did my money go last month?” The AI could then generate a pie chart showing the breakdown of expenses by category, such as housing, food, transportation, and entertainment. This allows the user to quickly identify areas where they are overspending and make adjustments to their budget.

Monitoring Investment Performance

For investors, the AI could provide visualizations of portfolio performance over time, comparing it to benchmark indices. A line graph could show the growth of the portfolio relative to the S&P 500, allowing the user to assess their investment strategy’s effectiveness. Users could also ask more granular questions like, “How are my tech stocks performing?”

Projecting Future Savings

Planning for retirement or other long-term goals becomes easier with visual projections. The AI could generate a chart showing the projected growth of savings based on current contributions and investment returns. Users can experiment with different scenarios, such as increasing contributions or changing investment allocations, to see how it impacts their future savings.

Understanding Debt Repayment

Managing debt can be overwhelming, but visualizations can help. The AI could create a chart showing the progress of debt repayment over time, illustrating the impact of different payment strategies. Users can see how increasing their monthly payments or consolidating debt can accelerate the repayment process and save them money on interest.

The Future of AI-Powered Financial Visualization

The potential of AI-powered financial visualization is vast. As AI technology continues to evolve, we can expect even more sophisticated and personalized visualizations that provide deeper insights and empower users to make even better financial decisions. The integration of predictive analytics will allow users to anticipate future financial challenges and opportunities, enabling them to proactively plan for the future.

Furthermore, the increasing availability of financial data will fuel the development of more comprehensive and accurate visualizations. Open banking initiatives and the proliferation of financial apps are making it easier for users to connect their financial accounts and share their data with AI-powered platforms. This will lead to more holistic and personalized financial insights.

However, it’s crucial to address the ethical considerations surrounding the use of AI in finance. Data privacy, security, and bias are paramount concerns that must be addressed to ensure that AI-powered financial tools are used responsibly and ethically. Transparency and explainability are also essential to build trust and ensure that users understand how the AI is making decisions.

Addressing Potential Challenges

While the benefits of Google AI Visualizes Your Finance Questions! are undeniable, several challenges need to be addressed to ensure its widespread adoption and effectiveness:

- Data Security and Privacy: Users need to be confident that their financial data is secure and protected from unauthorized access. Robust security measures and clear privacy policies are essential to build trust.

- Data Accuracy and Reliability: The accuracy of the visualizations depends on the quality of the underlying data. It’s crucial to ensure that the data is accurate, complete, and up-to-date.

- Algorithmic Bias: AI algorithms can be biased if they are trained on biased data. It’s important to identify and mitigate potential biases to ensure that the visualizations are fair and unbiased.

- User Education and Training: Users need to understand how to interpret the visualizations and use them effectively. Educational resources and training programs can help users develop the necessary skills.

Overcoming these challenges will require a collaborative effort from technology companies, financial institutions, regulators, and consumers. By working together, we can ensure that AI-powered financial visualization tools are used responsibly and ethically to empower individuals to take control of their financial futures.

In conclusion, Google AI’s ability to visualize finance questions represents a significant leap forward in personal finance management. By transforming complex data into easily understandable visuals, it empowers individuals to make informed decisions, track their progress, and achieve their financial goals. As AI technology continues to evolve, we can expect even more innovative and personalized financial solutions that will revolutionize the way we manage our money, making financial literacy and empowerment accessible to all.